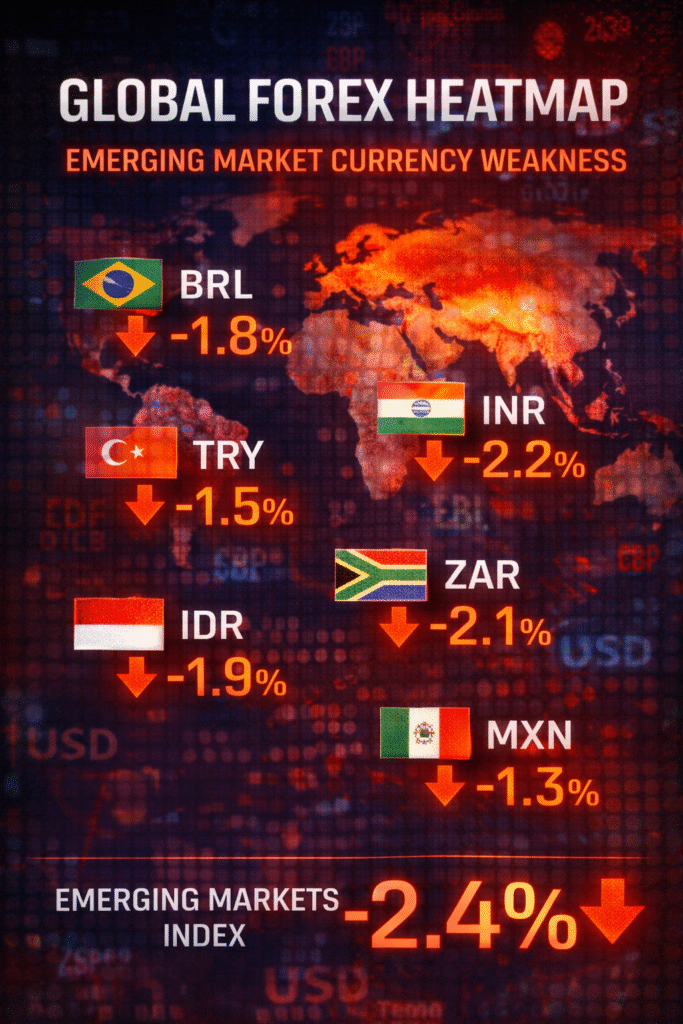

The Indian Rupee just hit a historic low. We break down the global “perfect storm” causing this tumble and what it actually means for your savings.

Rupee Depreciation has officially reached a level that has every analyst and household talking: a record low of 91.99 against the US Dollar. If you’ve been planning an international trip or looking to buy that latest tech gadget, this news probably feels like a punch to the gut. But let’s have a real conversation about what’s actually happening behind the scenes. This isn’t just a random number on a screen; it’s a reflection of a massive global tug-of-war. For those of us in our 20s and 30s, seeing the currency slide this far can be alarming, but understanding the “why” is the only way to protect your financial future.

The Dollar’s “Superpower” Phase

First, we have to look at the other side of the coin: the US Dollar. It’s currently in what experts call a “superpower” phase. As global uncertainty rises, driven by geopolitical tensions and shifting trade alliances, investors are fleeing “riskier” emerging market currencies and hiding their money in the safety of the Dollar.

When the demand for Dollars goes up, the value of the Rupee naturally comes down. This Rupee Depreciation is being fueled by “Capital Outflow,” which is just a fancy way of saying that foreign investors are pulling their money out of the Indian stock market and moving it back to the US where interest rates are higher. It’s a classic case of the “safe-haven” trade, and unfortunately, the Rupee is caught in the crossfire.

The Oil and Import Headache

Now, let’s talk about why this matters for your daily life. India imports a huge portion of its oil and electronic goods. Since these items are priced in Dollars, a weaker Rupee means everything becomes more expensive for the country to buy. This is what we call “imported inflation.”

When the government has to pay more for oil because of Rupee Depreciation, that cost eventually trickles down to the petrol pump, and from there, to the price of your groceries and Amazon deliveries. If you feel like your 10,000-rupee budget isn’t stretching as far as it did last year, you’re looking at the direct result of this currency tumble. It’s a silent tax on your purchasing power that hits everyone from students to small business owners.

Why Is This Happening Right Now?

You might be asking, “Why 91.99, and why today?” The perfect storm consists of three main ingredients:

- US Fed Policy: The American central bank is keeping interest rates high, making the Dollar more attractive to hold than the Rupee.

- Geopolitical Jitters: With tensions rising in Eastern Europe and the Middle East, the global market is in a “panic-first, ask-questions-later” mode.

- Trade Deficits: India is buying more from abroad than it is selling, which puts constant downward pressure on the local currency.

How to Protect Your Wallet

So, how do you navigate a world where your currency is losing its grip? It’s not all doom and gloom if you have a strategy:

- Diversify Your Assets: Consider holding some investments in international mutual funds or US stocks. This way, if the Rupee falls, your Dollar-denominated assets actually gain value.

- Hedge Your Travel: If you’re planning a trip abroad in six months, don’t wait until the last minute to buy your foreign exchange. Consider “averaging” your purchases over several months.

- Support Local: As imports get pricier, locally manufactured goods become more competitive. This could be a boon for the “Make in India” initiative, even if it hurts our pockets in the short term.

The Silver Lining (Yes, There Is One!)

While Rupee Depreciation sounds like a nightmare for travelers and gadget lovers, it’s actually a win for exporters. If you’re a freelancer working for US clients or a software engineer in an outsourcing firm, your Dollar earnings are now worth significantly more when converted back home. For the IT sector and textile exporters, this record low is actually a massive revenue boost.

The New Economic Normal

We are living through a historic realignment of global wealth. The fall to 91.99 is a wake-up call that the old rules of currency stability are changing. Whether you’re an investor or just someone trying to manage a monthly budget, staying informed about Rupee Depreciation isn’t optional, it’s essential. Keep your eyes on the global charts, stay flexible with your spending, and remember: in the world of finance, knowledge is the only currency that never loses its value.

+ There are no comments

Add yours