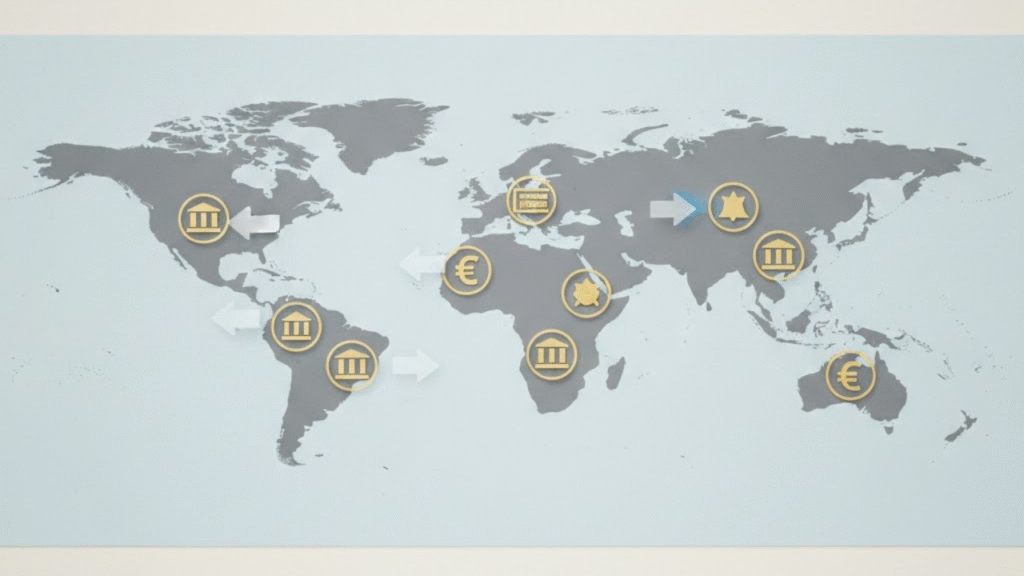

The era of “cheap money” remains out of reach. We break down why the Fed, ECB, and Bank of England are keeping the brakes on despite growing public outcry.

Global Interest Rates are currently the biggest source of frustration for anyone with a mortgage, a credit card, or a business to run. If you were hoping that early 2026 would bring a wave of rapid rate cuts, I’ve got some sobering news: the world’s central banks are in a collective state of hesitation. Despite political pressure and a cooling labor market, the “big three”—the Federal Reserve, the European Central Bank, and the Bank of England—are keeping their target rates steady. Let’s have a candid conversation about why these institutions are so afraid to move. If you feel like your bank is squeezing you more than usual, it’s because the macro-economy is stuck in a “high-for-longer” loop that shows no signs of breaking just yet.

The Ghost of Sticky Inflation

The primary reason behind this hesitation is a phenomenon economists call “Sticky Inflation.” While the headline prices of things like gas and cars have stabilized, the cost of services—think insurance, healthcare, and education—remains stubbornly high. Central banks are terrified of cutting Global Interest Rates too early, only to have inflation surge back to 4% or 5%.

Think of it like a doctor stopping an antibiotic course too soon. The “infection” (inflation) might look like it’s gone, but it’s actually just waiting to flare up again. For the Fed, which is currently holding rates at 3.50–3.75%, the memory of the 1970s “double-peak” inflation is a ghost that still haunts their meeting rooms. They would rather cause a mild recession than let inflation become a permanent part of the landscape.

The Labor Market Paradox

Another layer of this story is the job market. Usually, high interest rates lead to mass unemployment, which eventually forces banks to cut rates. However, in 2026, we are seeing a “Low-Hire, Low-Fire” economy. While big tech firms like Amazon and UPS have announced layoffs, the overall unemployment rate has remained relatively stable at 4.4%.

This stability is actually a problem for the banks. Because people still have jobs, they are still spending, which keeps upward pressure on prices. As long as the labor market doesn’t “break,” central banks feel they have the permission to keep Global Interest Rates restrictive. It’s a K-shaped reality: while high-income earners are benefiting from high-yield savings and a booming stock market, lower-income households are struggling with the soaring cost of debt.

How This Hits Your “Kitchen Table” Finances

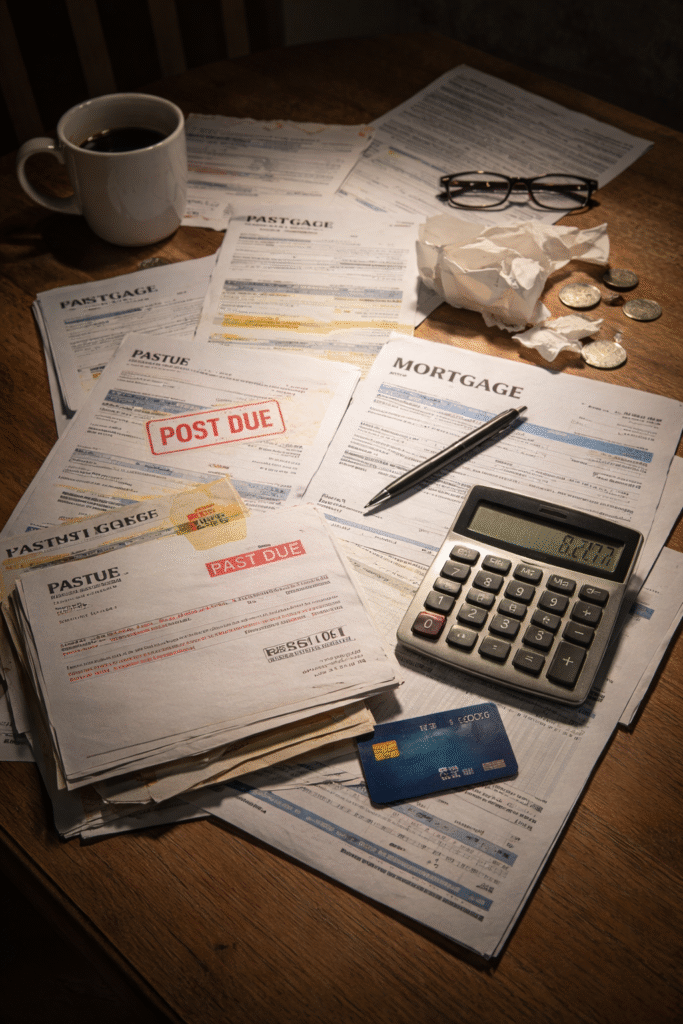

It’s easy to get lost in the jargon of “basis points” and “fiscal impulses,” but let’s talk about the real-world impact on your wallet:

- The Credit Card Trap: With no rate cuts on the horizon, credit card APRs are staying near 20-25%. This is creating a rare moment of bipartisan agreement in the U.S., with 63% of the public now supporting a 10% cap on interest rates.

- The Mortgage Freeze: Home price growth is finally slowing down (hitting a low of 2.9%), but because mortgage rates are staying high, many first-time buyers are still priced out.

- The Yield Advantage: On the positive side, if you have cash sitting in a high-yield savings account or short-term Treasuries, you are earning a “risk-free” return that we haven’t seen in decades.

The “New Normal” for 2026

So, when will the relief finally come? The expert consensus for Global Interest Rates has shifted from “fast cuts” to “simultaneous hold.” Most major banks are now expected to stay inactive until at least mid-2026. They are waiting for a “large negative surprise” in the data—something that proves the economy is finally cooling enough to let inflation die down.

Staying Solvent in a High-Rate World

We are living through a historic transition where money actually has a cost again. The era of zero-percent interest was an anomaly, and 2026 is proving that the “New Normal” is a much tougher environment to navigate.

Whether you’re looking to refinance a loan or just trying to manage your monthly credit card bill, the strategy is clear: assume rates aren’t going down anytime soon. Pay down high-interest debt aggressively, keep your cash in yield-bearing accounts, and wait for the central banks to finally blink. The game of chicken between the banks and the markets is far from over.

+ There are no comments

Add yours