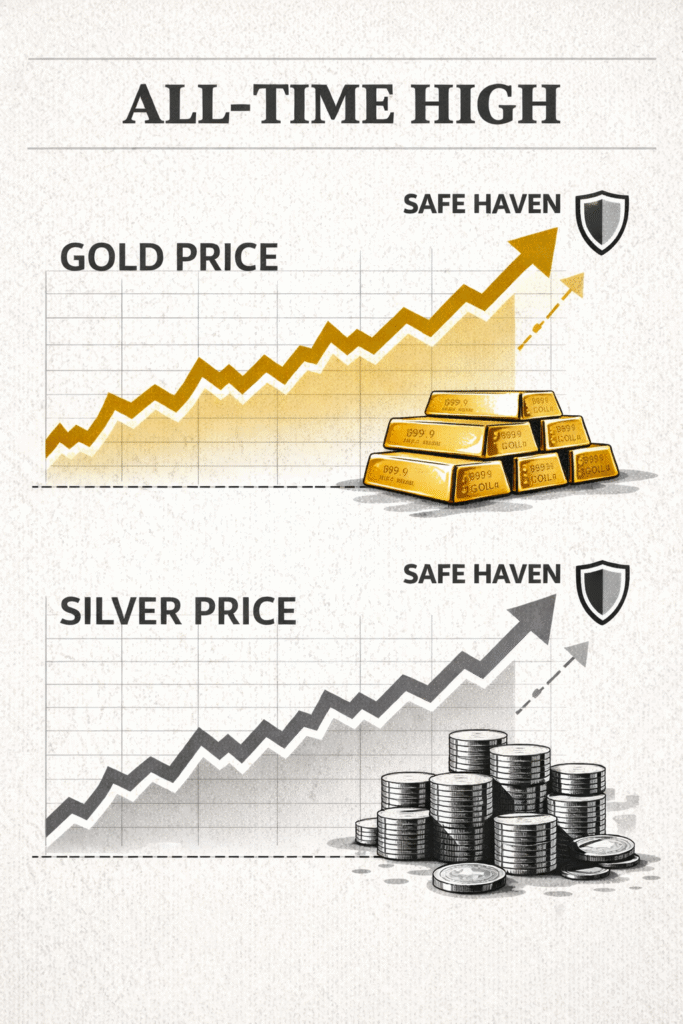

Forget the stock market noise. Discover the ultimate reason why gold and silver are shattering records and what it means for your financial future.

Precious Metals are currently the main character of the global financial story, and the numbers are honestly jaw-dropping. If you’ve glanced at the news this January 2026, you’ve likely seen the headlines: gold is flirting with $5,000 an ounce, and silver has surged to levels we haven’t seen in over a decade. But let’s be real—this isn’t just about shiny bars sitting in a dark vault; it’s a massive, systemic shift in how the world’s biggest players view safety. For those of us in our 20s and 30s, seeing these record highs can feel a bit overwhelming, but understanding the “why” behind this rally is the first step to staying ahead of the game.

The Geopolitical Spark: Why the World is Scared

Let’s have a candid conversation about what is actually driving this. Geopolitical risk is the primary fuel for this fire. The recent standoff involving the U.S. and Greenland, coupled with ongoing tensions in the Middle East and East Asia, has sent a shockwave through traditional paper currencies. When the world feels unstable, big investors stop trusting the digital numbers on a screen and start trusting “hard” assets that have survived for thousands of years.

This isn’t just a trend; it’s what experts call the “debasement trade.” Governments are printing more money to handle global crises, which naturally lowers the value of that money. In response, smart money is moving away from sovereign bonds and piling into Precious Metals. Gold and silver are essentially the world’s oldest insurance policies, and right now, every central bank on the planet is trying to buy premium coverage.

The Silver Surge: More Than Just a Haven

While gold usually gets the flashy headlines, silver is the real disruptor in this current market. Silver has actually outperformed gold in recent weeks, and it’s not just because people are looking for a cheaper safe haven. Silver has a dual personality that makes it incredibly powerful: it’s a protector of wealth, yes, but it’s also an industrial powerhouse.

Think about the global push for green energy. Silver is a core component in solar panels, electric vehicle electronics, and 5G infrastructure. We are currently facing a structural supply deficit, meaning the world is using more silver than the mines can pull out of the ground. This combination of “fear-driven buying” and “industry-driven demand” has created a perfect storm, causing prices to skyrocket in a way that feels permanent rather than temporary.

Why This Matters for Your Wallet

You might be wondering, “Why should I care if gold is expensive if I don’t own any?” The answer is inflation protection. When Precious Metals rise sharply, it’s often a signal that the purchasing power of your cash is shrinking. If the cost of gold goes up, the cost of groceries and fuel usually isn’t far behind. Understanding this rally allows you to position your savings so they don’t lose value while the world remains in flux.

Navigating the Rally: What Should You Do?

So, how does the average professional navigate this? You don’t need to be a billionaire to protect your savings, but you do need a strategy. Analysts suggest that while the rally is powerful, the volatility is very real. Here is how the landscape is shifting for individual investors:

The Opportunity in the Dips: Many experts are viewing any slight price corrections not as a crash, but as an “attractive entry point.” If the fundamentals of the world haven’t changed, the value of Precious Metals likely won’t either.

Central Bank Dominance: Countries like Poland and China are hoarding gold at record rates. This creates a “price floor,” meaning even if the price dips, these giant buyers will likely step in and push it back up.

Digital vs. Physical: For our generation, you don’t necessarily need a heavy safe in your basement. Digital Gold and Silver ETFs or blockchain-backed precious metals allow you to jump into the market with a few taps on your phone.

The New Era of Value

We are living through a historic rebasing of what “value” looks like. The Precious Metals rally isn’t just a short-term spike; it’s a reflection of a global society that is reassessing risk in real-time. Whether you’re looking at a 10-gram gold bar or a silver-backed digital asset, the message is clear: in an era of massive uncertainty, tangible assets remain king.

Don’t just watch the prices climb from the sidelines. Understand the forces at play—the debt, the technology, and the global tensions—and decide how you want to protect your own digital and physical wealth. Your future self will thank you for paying attention when the world was changing.

For more updates – Today News

+ There are no comments

Add yours